Mortgage rates are at the forefront of many homeowners’ and prospective buyers’ minds. Understanding the current landscape, influenced by economic factors like inflation and Federal Reserve policy, is crucial for navigating the complexities of homeownership. This guide delves into current trends, future predictions, and strategies for securing the best possible rate, providing a comprehensive overview for informed decision-making.

From analyzing the impact of economic indicators on affordability to exploring different mortgage types and refinancing options, we’ll unpack the multifaceted world of mortgage rates. We’ll examine how these rates affect not only individual finances but also broader economic trends, including consumer spending and the housing market itself. This analysis will equip readers with the knowledge to make smart financial choices in the ever-changing mortgage market.

Current Mortgage Rate Trends

Mortgage rates, a key driver of the housing market, have experienced significant fluctuations recently, impacting both prospective homebuyers and refinancing homeowners. Understanding these trends is crucial for navigating the complexities of the current market. This analysis examines average rates across various loan types, the underlying factors influencing these changes, and a comparison to historical averages.

Average Mortgage Rates Across Loan Types

Current average mortgage rates vary depending on the loan type and term. As of October 26, 2023 (data subject to change and dependent on lender and borrower profile), 30-year fixed-rate mortgages are averaging around 7.5%, while 15-year fixed-rate mortgages are slightly lower, hovering around 6.75%. Adjustable-rate mortgages (ARMs), which carry greater risk due to fluctuating interest rates, are showing rates ranging from 6.25% to 7.0%, depending on the terms and the index used.

These figures represent national averages and may differ regionally.

Factors Influencing Recent Changes in Mortgage Rates

Several interconnected factors contribute to the current mortgage rate environment. The most significant is the Federal Reserve’s monetary policy. The Fed’s ongoing efforts to combat inflation through interest rate hikes directly impact mortgage rates, as lenders base their rates on the prevailing market conditions, including the federal funds rate. Additionally, investor sentiment, economic growth forecasts, and the overall performance of the bond market play crucial roles.

For instance, concerns about a potential recession can lead to increased demand for safer investments like government bonds, pushing bond yields down and, conversely, influencing mortgage rates upwards. The supply and demand dynamics within the housing market itself also influence rates; high demand with limited supply can push rates higher.

Comparison of Current Mortgage Rates to Historical Averages

Comparing current rates to historical averages provides valuable context. Over the past 20 years, 30-year fixed-rate mortgages have averaged between 4% and 6%, with periods of both significantly lower and higher rates. The current rates are considerably higher than the historical average, reflecting the current inflationary environment and the Fed’s policy response. This disparity highlights the current market’s relative expense for borrowers compared to the past two decades.

Mortgage Rate Data Table

| Loan Type | Interest Rate (approx.) | Points (approx.) | Average Loan Amount (approx.) |

|---|---|---|---|

| 30-Year Fixed | 7.5% | 0.5 – 1.0 | $400,000 |

| 15-Year Fixed | 6.75% | 0.25 – 0.75 | $350,000 |

| 5/1 ARM | 6.25% – 7.0% | 0 – 0.5 | $300,000 |

Impact of Economic Factors on Mortgage Rates

Mortgage rates, the interest rates borrowers pay on home loans, are significantly influenced by a complex interplay of economic factors. Understanding these relationships is crucial for both borrowers seeking mortgages and lenders assessing risk. Shifts in inflation, monetary policy, unemployment, and broader economic indicators directly impact the cost and availability of borrowing for housing.

Inflation’s Influence on Mortgage Rates

Inflation, the rate at which the general level of prices for goods and services is rising, and mortgage rates share a strong positive correlation. When inflation rises, the Federal Reserve typically responds by increasing interest rates to cool down the economy and curb price increases. This increase in the federal funds rate (the target rate the Fed sets for overnight lending between banks) directly influences the rates banks charge each other, and subsequently, the rates they offer for mortgages.

Higher inflation expectations also lead to increased borrowing costs as lenders seek to protect their returns against eroding purchasing power. For example, the high inflation of the late 1970s and early 1980s coincided with a period of extremely high mortgage rates, exceeding 18% in some cases.

The Federal Reserve’s Monetary Policy and Mortgage Rates

The Federal Reserve’s monetary policy is a primary driver of mortgage rate fluctuations. The Fed uses various tools, including adjusting the federal funds rate, to influence the money supply and inflation. A tightening of monetary policy, often involving raising interest rates, typically leads to higher mortgage rates as borrowing becomes more expensive. Conversely, an easing of monetary policy, such as lowering interest rates, usually results in lower mortgage rates, making borrowing more attractive.

The Fed’s actions are not immediate; there’s a lag effect, meaning the full impact of policy changes on mortgage rates may not be felt for several weeks or months. The quantitative easing programs implemented after the 2008 financial crisis, for instance, helped to lower long-term interest rates, including mortgage rates.

Unemployment Rates and Mortgage Lending

Unemployment rates significantly affect mortgage affordability and lending practices. High unemployment generally leads to lower consumer confidence and reduced demand for housing, potentially putting downward pressure on mortgage rates. However, lenders also become more cautious during periods of high unemployment, tightening lending standards and potentially increasing the required down payments or credit scores for loan approval. This makes it harder for some borrowers to qualify for a mortgage, even if rates are relatively low.

Conversely, low unemployment typically translates to increased consumer confidence and stronger demand for housing, potentially leading to higher mortgage rates as competition increases. The 2008 financial crisis serves as a prime example: high unemployment coupled with stricter lending standards led to a significant contraction in the housing market.

Impact of GDP Growth and Consumer Confidence

GDP growth and consumer confidence act as leading indicators that influence mortgage rate movements. Strong GDP growth, indicating a healthy economy, typically leads to increased demand for housing and thus higher mortgage rates. Similarly, high consumer confidence suggests greater willingness to take on debt, further contributing to increased demand and potentially higher rates. Conversely, weak GDP growth and low consumer confidence signal economic uncertainty, potentially leading to lower demand for housing and reduced mortgage rates.

The period following the dot-com bubble burst in 2000 saw a decrease in both GDP growth and consumer confidence, which corresponded to a period of lower mortgage rates.

Mortgage Rate Forecasts and Predictions

Predicting future mortgage rates is a complex undertaking, influenced by a multitude of interconnected economic factors. While no forecast is perfectly accurate, analyzing current trends and expert opinions provides a reasonable range of potential outcomes. This section will explore various expert predictions, Artikel potential rate trajectories under different economic scenarios, and highlight the inherent uncertainties involved in this forecasting process.

Expert Opinions on Future Mortgage Rate Movements

Several prominent financial institutions and economists offer varying perspectives on future mortgage rate movements. For instance, Goldman Sachs recently projected a modest increase in 30-year fixed mortgage rates over the next six months, citing anticipated inflation pressures and continued Federal Reserve tightening. Conversely, Morgan Stanley anticipates a more moderate increase, suggesting that the current economic slowdown might limit the extent of rate hikes.

These differing predictions highlight the inherent difficulty in accurately forecasting such a dynamic market. The discrepancies stem from differing assumptions about future inflation, economic growth, and Federal Reserve policy.

Scenario Analysis of Potential Mortgage Rate Trajectories

To illustrate the range of possibilities, consider three scenarios: a baseline scenario, an optimistic scenario, and a pessimistic scenario. The baseline scenario assumes a continuation of current economic trends, with moderate inflation and gradual interest rate increases by the Federal Reserve. Under this scenario, 30-year fixed mortgage rates might rise to an average of 7.5% by the end of the year.

The optimistic scenario assumes a quicker-than-expected decline in inflation, leading the Federal Reserve to pause or even reverse its rate hikes. This could result in 30-year fixed mortgage rates remaining relatively stable, around 7%. The pessimistic scenario assumes a more persistent inflationary environment, forcing the Federal Reserve to implement more aggressive interest rate increases. This could push 30-year fixed mortgage rates to 8.5% or higher by year-end.

These scenarios are not exhaustive, but they illustrate the potential range of outcomes based on differing economic assumptions.

Potential Risks and Uncertainties Associated with Mortgage Rate Forecasting

Forecasting mortgage rates is inherently uncertain due to the complex interplay of various factors. Unexpected geopolitical events, changes in consumer sentiment, and unforeseen shifts in the housing market can all significantly impact rate movements. For example, the unexpected outbreak of war in Ukraine in 2022 sent shockwaves through global energy markets, contributing to inflationary pressures and impacting interest rate decisions.

Furthermore, the accuracy of economic models used for forecasting is limited by the availability and quality of data, as well as the inherent difficulty in predicting human behavior. These uncertainties underscore the need for caution when interpreting any mortgage rate forecast.

Visual Representation of Predicted Mortgage Rate Trends

Imagine a line graph with time (months) on the x-axis and mortgage rates (percentage) on the y-axis. The graph would show three distinct lines representing the baseline, optimistic, and pessimistic scenarios Artikeld above. The baseline scenario would be represented by a gently upward-sloping line, starting at the current rate and gradually increasing to 7.5% by the end of the year.

The optimistic scenario would show a relatively flat line, hovering around the current rate. The pessimistic scenario would depict a steeper upward trend, reaching 8.5% or higher by year-end. The lines would diverge over time, illustrating the increasing uncertainty further into the future. The graph would clearly label each line and include a legend to identify the different scenarios.

A shaded area between the optimistic and pessimistic lines could represent the range of uncertainty associated with the forecast.

Mortgage Affordability and Homeownership

The recent surge in mortgage rates has significantly altered the landscape of homeownership, particularly impacting affordability for various income brackets. Understanding these shifts is crucial for both prospective homebuyers and policymakers aiming to navigate the complexities of the housing market. The interplay between interest rates, home prices, and income levels determines the accessibility of homeownership, with significant consequences for economic stability and social mobility.The impact of changing mortgage rates on home affordability is multifaceted and varies drastically across different income levels.

Higher rates increase the monthly mortgage payment, effectively reducing the purchasing power of potential homebuyers. For lower-income households, even a small increase in rates can make homeownership unattainable, forcing them to remain renters or consider less desirable housing options. Conversely, higher-income households, while still affected, often possess greater financial flexibility to absorb increased mortgage costs. This disparity widens the existing gap in homeownership rates between different socioeconomic groups.

Impact of Mortgage Rates on Housing Market Dynamics

Rising mortgage rates directly influence housing market activity. Higher borrowing costs reduce demand, leading to a slowdown in sales and potentially lower home prices. This effect is particularly pronounced in markets already experiencing price sensitivity or a lack of inventory. Conversely, periods of lower rates stimulate demand, driving up prices and potentially leading to a more competitive market.

The relationship between mortgage rates and housing market activity is not always linear, however, as other factors such as economic growth, employment levels, and government policies also play significant roles. For example, the 2008 financial crisis saw a dramatic increase in foreclosures, directly related to rising interest rates and the subsequent housing market crash.

Mortgage Affordability: A Historical Comparison

Comparing the current mortgage affordability landscape to previous periods reveals important trends. The period following the 2008 financial crisis, for instance, saw historically low interest rates, which fueled a surge in homebuying activity. This led to a period of rapid price appreciation in many markets. The current environment, with significantly higher rates, represents a stark contrast. Analysis of historical data on mortgage rates, home prices, and income levels allows for a comprehensive understanding of the cyclical nature of housing market affordability and helps to inform predictions about future trends.

Comparing affordability indices across different time periods highlights the relative ease or difficulty of homeownership for various income groups throughout history.

Challenges Faced by First-Time Homebuyers

Rising mortgage rates pose significant challenges for first-time homebuyers, who often have limited savings and rely heavily on financing. The increased monthly payments associated with higher rates can push homes beyond their reach, especially in competitive markets with high home prices. This can lead to increased rental costs and delayed entry into homeownership, impacting their long-term financial security and wealth accumulation.

Government programs aimed at supporting first-time homebuyers, such as down payment assistance, become increasingly important in such environments to mitigate the effects of higher mortgage rates. For example, the significant increase in rates seen in late 2022 and early 2023 immediately reduced the number of first-time homebuyers entering the market, showcasing the direct impact of interest rates on this group.

Types of Mortgages and Their Rates

Navigating the mortgage market requires understanding the diverse options available, each with its own set of eligibility criteria, interest rates, and associated fees. The type of mortgage chosen significantly impacts the overall cost of homeownership, influencing monthly payments and the total amount paid over the loan’s lifespan. This section Artikels the key characteristics of several common mortgage types.

Conventional Mortgages

Conventional mortgages are not insured or guaranteed by a government agency. Lenders typically require a higher credit score and a larger down payment (often 20%) compared to government-backed loans. This lower risk profile often translates to more competitive interest rates. However, private mortgage insurance (PMI) may be required if the down payment is less than 20%, adding to the overall cost.

- Characteristics: Offered by private lenders; typically requires a higher credit score and down payment; potentially lower interest rates than government-backed loans.

- Interest Rates: Highly variable, influenced by credit score, loan-to-value ratio (LTV), and prevailing market conditions. Rates are generally lower than FHA or VA loans for borrowers who qualify.

- Eligibility Requirements: Strong credit history (typically a FICO score above 620); sufficient income to meet debt-to-income (DTI) ratios; a down payment (usually 20% or more); satisfactory appraisal of the property.

- Associated Fees: Origination fees, appraisal fees, title insurance, closing costs, and potentially PMI if the down payment is less than 20%.

FHA Mortgages

FHA loans are insured by the Federal Housing Administration, allowing for lower down payments (as low as 3.5%) and more lenient credit score requirements than conventional loans. This makes homeownership more accessible to first-time buyers and those with less-than-perfect credit. However, FHA loans typically carry a slightly higher interest rate than comparable conventional loans, and borrowers pay an upfront mortgage insurance premium (UFMIP) and an annual premium.

Mortgage rates are significantly impacting home affordability, creating a challenging market for prospective buyers. The current economic climate feels, in some ways, like a high-stakes Game of chance, where the winning strategy involves navigating unpredictable rate fluctuations. Ultimately, understanding these shifts is crucial for making informed decisions about mortgage financing.

- Characteristics: Insured by the FHA; allows for lower down payments and less stringent credit requirements; higher interest rates than comparable conventional loans.

- Interest Rates: Generally higher than conventional loans with similar terms, reflecting the increased risk for the lender.

- Eligibility Requirements: Credit score requirements are generally lower than conventional loans; a smaller down payment is allowed (as low as 3.5%); income verification and debt-to-income ratio assessment are necessary.

- Associated Fees: UFMIP (Upfront Mortgage Insurance Premium), annual mortgage insurance premiums (MIP), closing costs, appraisal fees.

VA Mortgages

VA loans are guaranteed by the Department of Veterans Affairs, offering several advantages to eligible veterans, active-duty military personnel, and surviving spouses. These loans often require no down payment and have more flexible credit requirements. However, a funding fee is typically required, and interest rates can vary depending on market conditions and the borrower’s creditworthiness.

- Characteristics: Guaranteed by the VA; often requires no down payment; more lenient credit requirements; funding fee is typically required.

- Interest Rates: Competitive with conventional loans, but can vary based on market conditions and borrower profile.

- Eligibility Requirements: Must be a qualified veteran, active-duty service member, or eligible surviving spouse; certificate of eligibility from the VA; meet specific credit and income requirements.

- Associated Fees: Funding fee (percentage of the loan amount), closing costs, appraisal fees.

Finding the Best Mortgage Rate

Securing the best mortgage rate is crucial for minimizing the overall cost of homeownership. A seemingly small difference in interest rate can translate into significant savings—or losses—over the life of the loan. This requires a proactive and informed approach to the mortgage shopping process.

Navigating the complexities of mortgage rates demands a strategic approach. Borrowers must understand the factors influencing rates, diligently compare offers, and proactively improve their financial profile to maximize their chances of securing the most favorable terms. This involves more than simply checking a few online calculators; it necessitates a comprehensive understanding of the lending landscape.

Factors Lenders Consider When Setting Mortgage Rates

Lenders employ a complex algorithm to determine mortgage rates, factoring in several key elements. Credit score is paramount; higher scores generally translate to lower rates. The loan-to-value ratio (LTV), representing the loan amount as a percentage of the home’s value, also plays a significant role. A lower LTV typically results in a better rate, as it signifies lower risk for the lender.

The type of mortgage—e.g., 30-year fixed-rate, 15-year fixed-rate, adjustable-rate mortgage (ARM)—significantly impacts the rate. Prevailing market interest rates, influenced by broader economic conditions, also exert considerable influence. Finally, the borrower’s debt-to-income ratio (DTI) is a crucial factor; a lower DTI indicates greater ability to repay the loan, thus improving rate prospects. For example, a borrower with a 780 credit score, a 20% down payment (resulting in an 80% LTV), applying for a 30-year fixed-rate mortgage during a period of low interest rates and demonstrating a DTI of 35% will likely secure a more favorable rate than a borrower with a lower credit score, higher LTV, and higher DTI.

Steps to Take When Shopping for a Mortgage and Securing the Best Rate

Before embarking on the mortgage application process, borrowers should meticulously prepare. This includes checking their credit reports for accuracy and addressing any negative marks. A strong credit score is essential for securing the best rates. Next, they should pre-qualify for a mortgage with several lenders to obtain a general idea of their borrowing capacity and the rates they can expect.

This process doesn’t involve a hard credit inquiry, which would negatively impact their credit score. Once pre-qualified, borrowers should shop around, comparing offers from at least three to five lenders. Comparing interest rates, fees, and other loan terms is crucial for identifying the most advantageous offer. Negotiating with lenders is also advisable; some lenders may be willing to lower rates or fees to secure the borrower’s business.

Finally, borrowers should carefully review all loan documents before signing, ensuring a thorough understanding of the terms and conditions.

Comparing Offers From Multiple Lenders

Obtaining and comparing mortgage offers from multiple lenders is a critical step in securing the best rate. Each lender uses slightly different underwriting criteria and has its own pricing structure. By comparing offers side-by-side, borrowers can identify the lender offering the most favorable combination of interest rate, fees, and other loan terms. This comparative analysis should consider not only the initial interest rate but also the total cost of the loan over its lifetime, including closing costs, points, and any potential prepayment penalties.

For instance, a slightly higher interest rate might be offset by lower closing costs, resulting in a lower overall cost. Utilizing online mortgage calculators can greatly simplify this comparison process.

Tips for Improving Your Credit Score to Qualify for a Lower Rate

A higher credit score is strongly correlated with lower mortgage rates. Borrowers can take several steps to improve their credit score before applying for a mortgage. These include paying all bills on time, reducing credit card debt, and avoiding applying for new credit unless absolutely necessary. Regularly checking credit reports for errors and disputing any inaccuracies is also important.

Maintaining a low credit utilization ratio—the amount of credit used relative to the total available credit—is another effective strategy. For example, consistently paying down credit card balances and keeping utilization below 30% can positively impact credit scores. The impact of these actions will vary depending on individual credit histories, but consistent effort generally yields positive results over time.

Mortgage Rate and Personal Finance

Mortgage rates are a cornerstone of personal financial planning, significantly impacting affordability, debt levels, and long-term wealth accumulation. Understanding their influence is crucial for making sound financial decisions, especially when considering homeownership. Fluctuations in rates directly affect monthly payments, the total cost of borrowing, and the overall financial health of individuals and families.Mortgage rates influence personal financial planning primarily through their impact on housing costs, the largest single expense for many households.

Higher rates translate to larger monthly mortgage payments, reducing disposable income available for other financial goals such as saving, investing, or paying down other debts. Conversely, lower rates free up more cash flow, potentially accelerating wealth building. This interplay necessitates careful budgeting and financial forecasting to account for these variations.

Managing Mortgage Payments During Rising Rates

Rising mortgage rates can strain household budgets. Several strategies can mitigate this impact. Refinancing to a lower rate (if available), extending the loan term to reduce monthly payments (though increasing total interest paid), or making extra principal payments to shorten the loan’s lifespan and reduce overall interest expense are common approaches. Careful budgeting and prioritizing expenses become even more critical during periods of rate increases.

Consider cutting back on discretionary spending or exploring additional income streams to maintain financial stability.

Long-Term Implications of Mortgage Terms and Rates

The choice between a shorter-term, higher-rate mortgage and a longer-term, lower-rate mortgage involves a trade-off between monthly payments and total interest paid. A 15-year mortgage typically commands a lower interest rate but requires significantly higher monthly payments. Conversely, a 30-year mortgage has lower monthly payments but results in substantially higher total interest paid over the loan’s life. The optimal choice depends on individual financial circumstances, risk tolerance, and long-term financial goals.

For example, a high-income earner with aggressive saving goals might opt for a 15-year mortgage to accelerate debt payoff and maximize investment returns. A family with young children and limited savings might prefer the lower monthly payments of a 30-year mortgage, prioritizing current cash flow.

Illustrative Budget Impact of a Rate Change

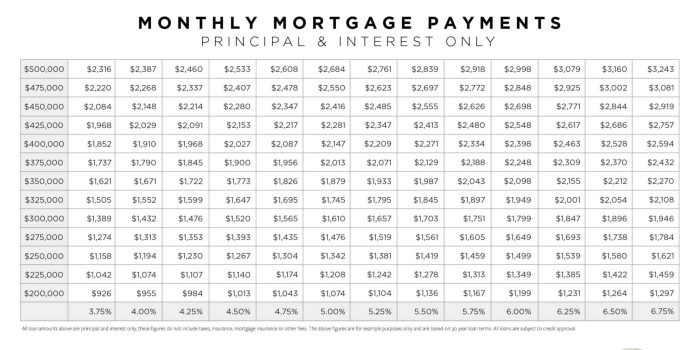

Consider a hypothetical scenario: A homeowner with a $300,000 mortgage at a 4% interest rate for 30 years faces a monthly principal and interest payment of approximately $1,432. If interest rates rise to 6%, their monthly payment increases to approximately $1,798, a difference of $366 per month. This $366 represents a significant portion of a household’s budget and underscores the need for careful financial planning to absorb such changes.

A simple budget might allocate 30% of income towards housing. A rate increase could force adjustments in other budget categories like food, transportation, or entertainment to maintain this allocation. This example highlights the need for contingency planning to handle unexpected increases in mortgage expenses.

Navigating the mortgage market requires a clear understanding of current rates, their underlying drivers, and potential future trajectories. By carefully considering various mortgage types, leveraging comparison shopping, and understanding the role of economic indicators, individuals can significantly improve their chances of securing favorable terms. Proactive financial planning, including credit score management, remains paramount in this process, enabling both homebuyers and those refinancing to achieve their financial goals.

FAQ Insights

What is a mortgage point?

A mortgage point is a fee paid upfront to reduce the interest rate on a loan. Each point typically costs 1% of the loan amount.

How often do mortgage rates change?

Mortgage rates fluctuate daily, often responding to changes in the broader economic climate and Federal Reserve actions.

What is an adjustable-rate mortgage (ARM)?

An ARM has an interest rate that adjusts periodically based on an index, like the LIBOR or SOFR, resulting in fluctuating monthly payments.

Can I lock in a mortgage rate?

Yes, lenders typically offer rate locks for a specified period, guaranteeing a rate for a certain timeframe before closing.

What is the difference between an FHA and a VA loan?

FHA loans are insured by the Federal Housing Administration, requiring lower down payments but often involving mortgage insurance premiums. VA loans are backed by the Department of Veterans Affairs and typically offer favorable terms to eligible veterans and military personnel.